Enneagram x Stock Picking (Part II): Type Twos Investing in AMC to Save Movie Theaters?

Do some people feel compelled to rescue their favorite businesses via investing? By Benjamin Tan

When Covid-19 hit, many retail businesses had to raise plenty of cash to tide through difficult times. Household names such as Royal Caribbean (RCL 0.00%↑) and Carnival (CCL 0.00%↑) undertook several rounds of equity and debt financings when cruises were cancelled. Movie theaters, large and small, resorted to various forms of fund raising, from grassroot-led campaigns to AMC Entertainment Holdings (AMC 0.00%↑) engineering an ingenious, large-scale meme stock phenomenon to rally individual investors.

What AMC CEO Adam Aron did to position the business as a damsel in distress - unfairly attacked by short-sellers; abandoned by the likes of Disney (DIS 0.00%↑) and AT&T (T 0.00%↑) - somehow resonated and rose above overarching fears of bankruptcy at the height of Covid. A large group of retail investors banded together to keep buying the stock, and the resultant price buoyancy allowed the company to raise significant equity capital. AMC was saved by everyday investors (fondly referred to as apes) who have since replaced institutional funds to become majority shareholders.

Who are AMC Apes?

While I am not drawn to AMC as an investment, I am a big fan of going to movie theaters. Must be a generational thing. I would not, however, have invested in AMC just to help the business stay alive. Perhaps it is because I do not identify as an Enneagram Type Two, which I suspect to be the dominant personality of many AMC apes.

Superman has a compulsion to save the world, even if it means paying for it with his own life. By the same token, Type Two investors (and AMC investors) may be operating with the same script. Proposals like rescue financing – especially if they involve the kind of corporations that Type Twos feel sentimental towards – likely resonate much deeper with their emotions than other investor types. As mentioned in a prior post (Why Do We Invest in Individual Stocks), underlying motivations in investing behaviors can vary widely. Different strokes for different folks and the Enneagram can be informative to identify our quirks as investors.

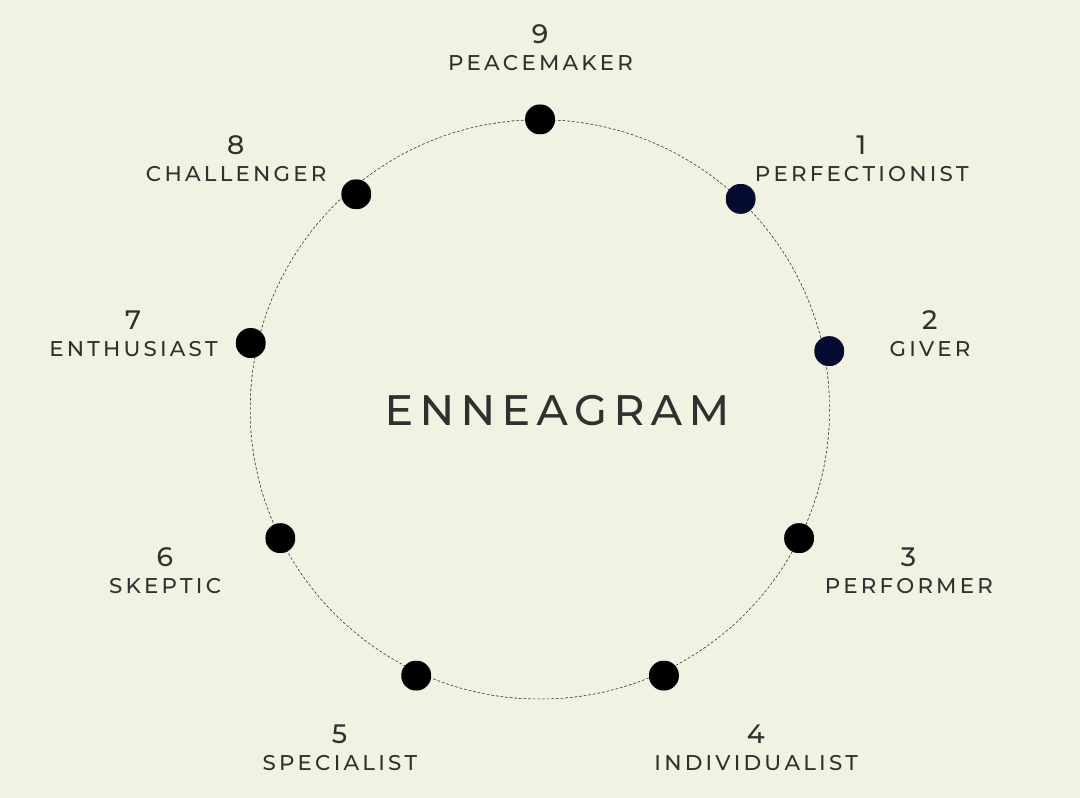

For quick reference, below are the primary motivations associated with each Enneagram type. I covered Type One on January 31st already.

Type Two: Givers

If you respond “Yes” to most of the statements below, you may be a Type Two (Giver):

Even when you are feeling down, you still have energy to help others, as it brings you immediate joy

At work, you focus more on relationships with co-workers and team dynamics, than your daily checklists or tasks of the week

Detecting the moods, thoughts, and emotions in others comes easily to you, and you always know what to say to people

Charitable causes tug your heartstrings, and you tend to make more donations than your peers

At work, you often find yourself taking on more than your fair share of responsibilities, because you feel personally obligated to do so, rather than doing it to improve your career advancement or professional image

You enjoy knowing that you have made a fundamental difference to the lives of those around you

Many movies glorify the most epic heroes as fearless warriors who are always prepared to die in service. Superman in Batman v Superman: Dawn of Justice risks his own vulnerabilities by wielding a kryptonite spear to attack Zod, only to perish in battle to save the world. More memorably, Jack Dawson in Titanic freezes to death so that Rose DeWitt Bukater may live. Love is measured by loss, which further romanticizes ideations of needing to save others.

For Type Two investors, while there is nothing wrong with wanting to support friends, family, and businesses, it becomes a problem when boundaries between investment merits and emotions are blurred. Are Type Two investors doing their part for charity to be good citizens, or are they making investments with implicit expectations of returns? Another valid question to consider is intent. Is it possible that certain Type Two investors are positioning themselves as white knights, even when doing so may put their financial positions in jeopardy? And do they secretly seek out situations in which they are financially needed to feed their own hungry hearts?

A key pitfall for Type Two investors is becoming someone else’s agenda, not their own. Whether or not their financial moves (investing in companies like AMC, Royal Caribbean, or seeding a relative’s start-up) work out is a separate matter. The more relevant issue is losing their sense of agency when it comes to fiscal decisions that should be made primarily on their own fruition, not how much they wish to feel of services to others.

Why Learning about Our Motivations for Stock Picking Matters

This is Part Two of a series of post that I will be writing on Enneagram x Stock Picking. I believe our best traits and core motivations are often accompanied by closely related blind spots and unhealthy biases. It is therefore important to clarify our primary motivations for investing in singular names, because they can reveal the specific personality pitfalls we face as investors.

To find out more about your typology, try the free test on my website.

I shall be writing more about Enneagram types and personal investing in the weeks to come. Stay tuned and subscribe. Meantime, visit my website “Enneagram Investing”

Follow me on Twitter @ConsumeOwnTech and Commonstock @ConsumeOwnTech

Represented by Savvy Literary

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

Latest Top 10 positions in my high conviction portfolio that combines value with growth stocks

Book recommendations on investing, consumer and technology sectors

One article delivered into your inbox every Tuesday

Preview of upcoming articles

Hi, I especially wanted to say I loved your blog and how well-curated it was. <a href="https://www.jksnews.com.ng/how-to-activate-amc-roku-on-tv-via-activation-code">AMC roku</a> can be a difficult topic to cover on the internet solely because of a lot of misleading information. I am very glad your article is down to earth and very informative. Kudos and keep up the good work.