Mid-Year Lessons from Project 350k

On pacing, personality, and portfolio missteps with my Traditional IRA account. By Benjamin Tan.

When I began Project 350k (see Part 1, Part 2, and Part 3) earlier this year, the idea was simple: grow a modest Traditional IRA portfolio into something far more substantial, eventually hitting a $350,000 target. The implied target return is around 15%—ambitious but not unachievable. Statutory limits on the amount of capital contributions would also cap the amount of risk I take relative to my net worth, which comprises a mix of home equity, REITs, fixed income, large caps, and mid-sized companies poised for S&P inclusions.

Now that we’re halfway through the year, I thought I’d pause and reflect on a few things I’ve already learned.

1. Timing of Deployments Matters:

With a contribution cap of $7,000 per year, I should have been more strategic with the timing and sizing of my buys. Not used to making deployments of this size, I was still operating the Traditional IRA account without being fully cognizant of limitations.

Between January and February alone, I made all four of my current investments:

Disney ( DIS 0.00%↑ ) : Purchased $2,782 @ $107/share (Jan 16)

Globant ( GLOB 0.00%↑ ) : Purchased $2,000 @ $200/share (Jan 27)

Life Time Group ( LTH 0.00%↑ ) : Purchased $1,153 @ $32.95/share (Feb 18)

Trupanion ( TRUP 0.00%↑ ) : Purchased $1,050 @ $35/share (Feb 20)

Looking back, I essentially used up the annual limit within the first six weeks of the year! That decision left me with no capital to act on better opportunities. When markets wobbled in April and May, I had to sell my stake in Warner Music Group ( WMG 0.00%↑ ) to free up capital. While that position was always earmarked for disposal due to its tepid growth profile, I still should have been more conservative with the deployments of this small portfolio.

There’s a discipline to pacing.

2. Sizing Should be Consistent

My allocations were uneven. Disney ( DIS 0.00%↑ ) and Globant ( GLOB 0.00%↑ ) got significantly larger portions than Life Time ( LTH 0.00%↑ ) or Trupanion ( TRUP 0.00%↑ ). If I had stuck to $1k per name, I could have left room for later conviction adds—or scaled out more gracefully as earnings reports came in during Q1.

3. Risk is About Me

Reentering Globant ( GLOB 0.00%↑ ), a name I had previously owned and profited from, felt safe. But it is a small cap. And historically, I have had a blind spot for these.

This particular investment turned into my Achilles' heel. Q1 results disappointed, and revenue guidance for 2025 is well below my minimal 10% threshold for Project $350K. I am now looking for an exit from this name. Meanwhile, larger-cap names I already hold in my trading account—like The Trade Desk ( TTD 0.00%↑ ) and Zscalar ( ZS 0.00%↑ )—have fared much better.

Ironically, I ignored them to “diversify.” Geez.

4. My personality Showed Up

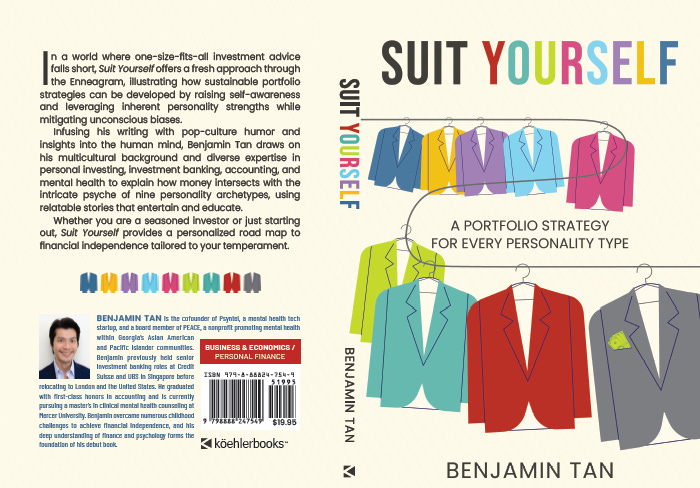

Looking back, I can see how much my personality shaped the early moves in this portfolio—perhaps more than I realized at the time. In my upcoming book, Suit Yourself, I explore how each of the nine Enneagram types tends to approach investing, with their own psychological biases and behavioral tics. As a Type 5 who can lean into a Type 7—optimistic and, at times, impulsive—I now recognize how those traits showed up in my decision-making.

The rush to deploy capital was not just about market timing. It was about chasing momentum, fearing I would miss out on ideal entry points. It felt like decisiveness, but in hindsight, it was impulsivity disguised as confidence. I told myself I was making bold, reasoned moves. But really, I was skipping the part where I pause, zoom out, and ask: “Is this the best use of limited capital right now?”

There’s a core lesson here: investors are not spreadsheets. We are human. And when left unchecked, our patterns—risk-averse or risk-seeking—can lead us astray, even when we know better. I have spent years studying valuation, business fundamentals, and capital cycles. Yet in this small account, the psychological impulse to act quickly overrode what should have been a more methodical deployment plan.

Self-awareness does not guarantee success but gives you a fighting chance to interrupt your worst habits. That’s what Suit Yourself—and this project—is really about.

Follow me on X.com (formerly Twitter) @ConsumeOwnTech and Yahoo Finance

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

My Top 10 high-conviction portfolio positions, combining value and growth stocks

Book recommendations in investing, consumer, and tech sectors

Monthly articles delivered straight to your inbox