Roku: Stick It Back into Netflix?

Roku was incubated in Netflix after all

Beyond the numbers, there are a couple of fundamental questions on Roku:

As more TV models are getting smarter, will Roku sticks still be relevant?

Alphabet has been throwing more incentives at TV OEMs to install their Android and Google operating systems. Will Roku level up its game? Roku is widely known to be adamant about not sharing its ad dollars with TV OEMs

In Q1 2022, active accounts rose sequentially by 1.1 million, its lowest quarterly add in a few years. Roku Player unit sales decreased 12% year-over-year, though up 20% compared to Q1 2019 (pre-Covid). Much of this weakness was attributed to supply chain issues. At the same time, it was not clear if there might also be a fundamental shift in the way TV buyers experience streaming. If a TV already comes with an operating system that carries the most popular streamers like Netflix and Disney+, will the consumer still use a Roku stick to override the OS?

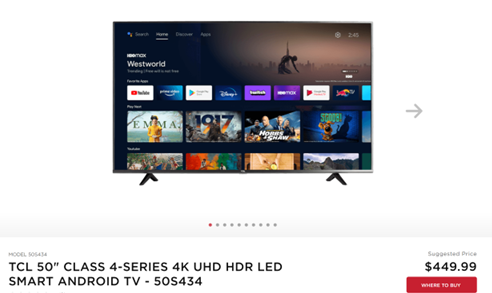

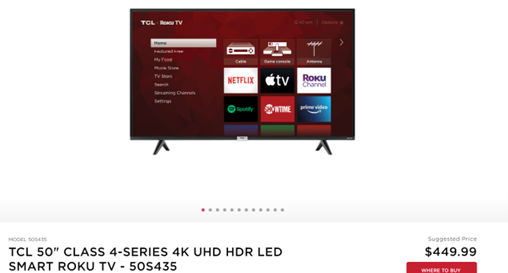

In foreign countries where TVs may be older, using a Roku stick would still be an amazing value proposition. But Roku’s international rollout has been slow to gain traction, given regulatory hurdles and need to curate local content. Meanwhile, OEMs like Hisense and TCL continue to widen their line-up with Android and Google TV operating systems, at similar price points to Roku-powered TVs.

Roku’s recent pivot towards content is designed to drive stronger consumer demand for Roku-powered TVs. From having more channels and apps than any other operating systems, to licensing more free shows and films (including Roku Originals produced by Roku itself) on Roku Channel, Roku is all-in. Even big guns like Reese Witherspoon and Daniel Radcliffe have been deployed to produce exclusive shows and films for Roku Channel.

And so, engagement on Roku Channel remains strong, consistently a top 5 channel on the Roku platform in the US by reach and engagement, despite a barrage of new streamers like HBO Max and Disney+ coming onboard.

Meanwhile, advertising on Roku has been a bright spot, with ARPU remaining above $40 for the third consecutive quarter. In Q1, it retained 96% of advertisers that spent $1M+ on a trailing 12-month basis, and average spend among returning advertisers increased more than 50% year on year. With the scale of more than 60 million active accounts, vast first party data, and an integrated ad platform (OneView), Roku’s advertising machine is sleek and killing it. CTV advertising is still in the early innings of hypergrowth, compared to all other forms of digital advertising, and Roku is benefiting from a rising tide.

See quote below from the earnings call:

“We are still putting up very robust growth for the ad business, and that's largely because we're still early in the movement of budgets into streaming. In the shareholder letter, we cited 46% of time spent in stream, but only 18% of ad budgets being spent. For us, that translates into: “are we going to be able to grow this account 100% year-over-year or 40% or 50% year-over-year”. Our per account spending is up 50% year-over-year, and we see significant increased commitments across every 1 of our segments, our large customer segment, our growth performance segment, our M&E segment. So the (macro) uncertainty does affect us, the magnitude of the shift is still very substantial. We're still putting up very substantial growth figures”

Long term, however, Roku needs to continue acquiring new active accounts to keep its entire ship afloat and its advertising engine running at full speed. While it is still the No. 1 TV streaming platform by hours streamed in the US, Canada, and Mexico, the threat from Alphabet – with Android TV and Google TV– is serious enough. Alphabet is the king of advertising, and if it continues to cozy up to more TV OEMs, Roku might find its original content to be an insufficient draw. Roku OS may be technologically superior, but Android TV is also catching up rapidly, with Alphabet’s backing.

Maybe it is time for Roku to cozy back up to Netflix? Netflix has the international infrastructure and loads of local content; Roku has a killer ad-stack ready for Netflix’s AVOD ambition.

(Author is a shareholder of Roku)

Subscribe to Consume Your Own Tech Investing to receive a welcome email with the following:

Latest Top 10 conviction Consumer and Tech positions in my portfolio

3 book recommendations on investing, consumer and technology sectors

One article delivered into your inbox every Tuesday

Preview of upcoming articles

In addition, you will receive a Subscriber-Only monthly email with updates to my portfolio convictions and latest recommendations on books to read.

Follow me on Twitter @ConsumeOwnTech