Salesforce: A Story of Profit Inflection

Continuing focus on margin expansion to rerate stock price. By Benjamin Tan

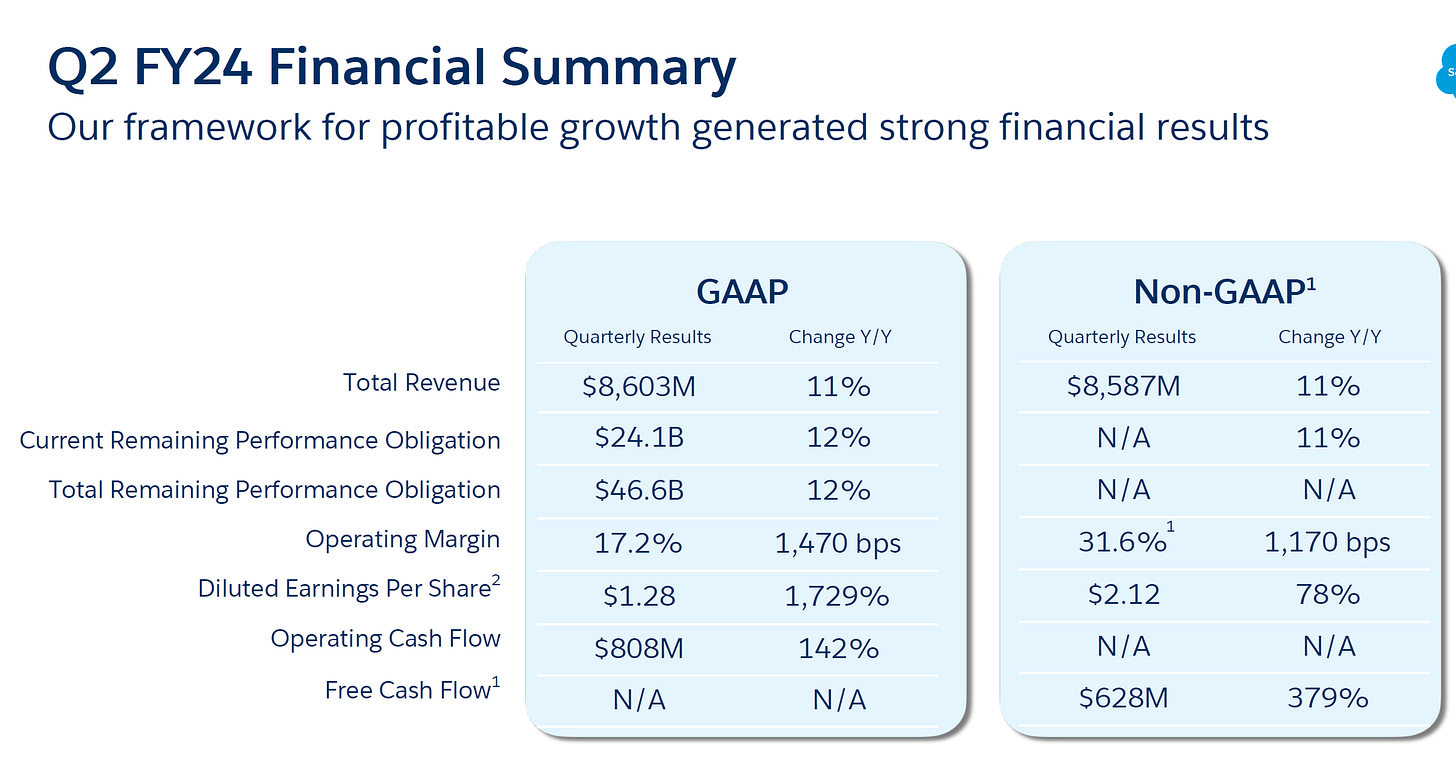

When Q2 2024 results were released on August 30, there were no surprises on topline growth or guidance. Revenue for the quarter grew by 11%, and for FY 2024, Salesforce (CRM 0.00%↑) barely raised its outlook—it still expects full-year growth to land at around 11%, consistent with Q2 trends and cRPO trajectory:

Q2 revenue: $8.60bn, up 11%

Current remaining performance obligation (cRPO): $24.1bn, up 12%

Q3 revenue guidance: $8.70—8.72bn, up 11%

Raises FY2024 revenue guidance to $34.7—34.8bn, up ~11%

Again, management did not reiterate its original FY 2026 $50bn revenue target, which remains uncommitted.

Absent major acquisitions and a budget flush that fueled the broader SaaS sector growth in 2020-2022, Salesforce today resembles a mature technology company, more so than the 20%-a-year grower it was during the aforementioned boom years.

Margins: A Different Story

While revenue has been within expectations, Salesforce is shaping a different narrative for its profitability story. Gone are the aggressive hiring, over-generous perks, and lax cost controls: Amid a weaker demand environment, management’s primary focus is to drive down costs as hard as possible to surprise on margins.

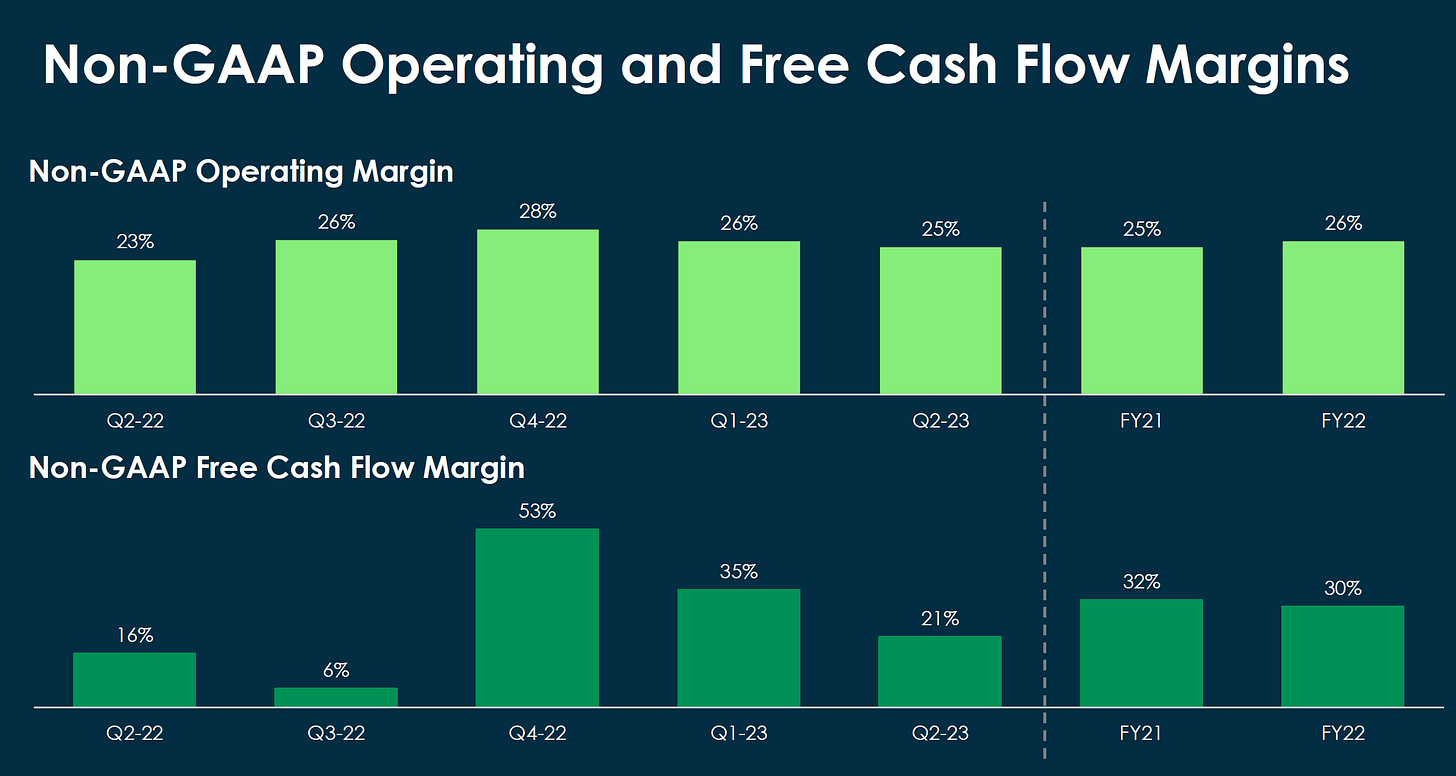

Just look at the latest cashflow and profitability trends:

Q2 diluted EPS (GAAP) grew by 1,729%

Q2 operating cash flow increased by 142%

Q2 free cashflow rose 379%

A Case of Catch-Up?

At its current scale ($35bn annually), it is somewhat surprising that Salesforce had only just surpassed 30% non-GAAP operating margin. In comparison, ServiceNow (NOW 0.00%↑)—another SaaS company at less than a quarter of Salesforce’s revenue—has been achieving roughly 20-30% margins since 2019.

That said, on the Q2 earnings call, Salesforce CFO Amy Weaver assures investors and Wall Street that healthy margins have only just begun. Salesforce operating margins may very well reach the heights of Microsoft and Adobe (40-50%) sooner than later:

And as I said last time, I really believe 30% annually is a floor, not a ceiling.

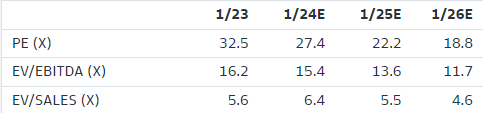

The markets overlooked years of ambitious acquisitions and unchecked spending when growth was the key selling point for software companies. Now, sentiment has shifted, and profitability—or at least the ability to prove substantial operating leverage—has become the main stock price driver.

However, with rapidly expanding margins, valuation for Salesforce may deserve another look:

This CRM giant stands a decent chance of reaccelerating revenue growth, if and when IT budgets recover in tandem with the broader economy. The runway for cloud-based software growth remains long—especially globally—and Salesforce has been a proven quality software platform since its founding in 1999.

For companies that have endured multiple economic cycles and are still dominant in their respective (growing) categories, investors should be willing to pay a premium, let alone a “wonderful company at a fair price,” to borrow a quote from Warren Buffett.

(Author is long $CRM)

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

Latest Top 10 positions in my high conviction portfolio that combines value with growth stocks

Book recommendations on investing, consumer, and technology sectors

Articles are delivered to your inbox on Tuesdays

Preview of upcoming articles

Follow me on Twitter @ConsumeOwnTech and Commonstock @ConsumeOwnTech