Salesforce: What is Behind This Cloud?

Q3 2023 results overshadowed by multiple management changes and macro conditions. By Benjamin Tan

When Q3 2023 results were released, there was no guidance initiated for the following full fiscal year, a tradition that had long been practiced by Salesforce (CRM 0.00%↑) until now. Given the recurring nature of its underlying businesses, it should not have been difficult to give some color on FY 2024, but Marc Benioff and his team held back. Markets therefore assumed that FY 2024 outlook must be bad, so the stock declined by 10% the next day. For a Dow 30 component stock, it was an unnerving move.

Q3 2022: Review of Financial Performance

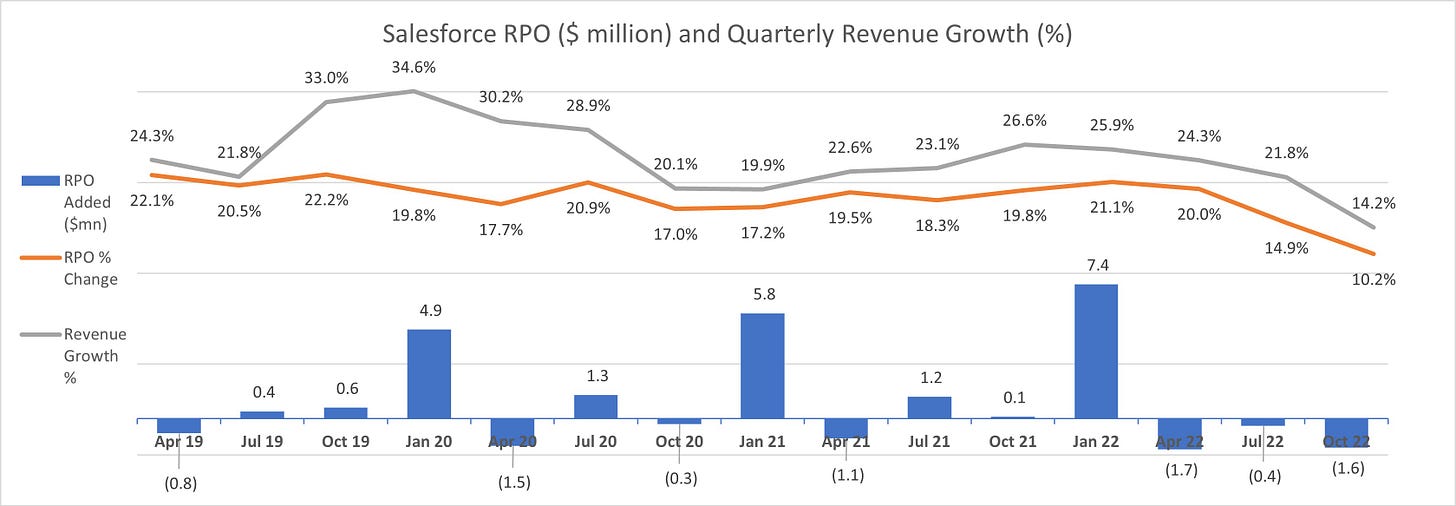

Given that EMEA and Asia account for more than 30% of consolidated revenues, the strong US dollar during the quarter was a drag on numbers. Revenue grew a mere 14.2%, a far cry from the usual 20-30% range that Salesforce had been reporting for years. On a constant currency basis, it was a healthier 19%. Bottomline performed much better, hence it took center stage in the press release and earnings call: non-GAAP operating margin exceeded guidance and tallied 22.7%, which is a record high. Salesforce responded to macro slowdown and market demand for profitability with a series of cost-cutting measures that promise further upside in the coming years. Management reiterated its commitment for non-GAAP operating margin to reach 25% or above by FY 2026. No word, however, on the corresponding $50bn revenue target.

A few other items to note from the latest quarter:

Remaining performance obligation (RPO) reflects sagging deal momentum, consistent with many other software companies. Of note, Q4 2022 current RPO is guided to grow by only 10% on a constant currency basis

Billings increased 5%, compared to 11% in Q2 and 28% the year prior

Revenue attrition remained below 7.5%, affirming stickiness of customer base

EMEA and APAC grew faster than Americas

Slack delivered topline growth of 46%. For a front office software in today’s macro environment, growth is surprisingly strong and durable. Slack is Salesforce’s largest acquisition in its corporate history

Group Co-CEO Bret Taylor will step down in the coming months. Subsequent to Q3 2022 earnings release, Salesforce announced impending departures of Mark Nelson (Tableau CEO) and Stewart Butterfield (Slack CEO) as well

FY 2024: Color from Reported Numbers

Extrapolating into FY 2024 from Q3 trajectories of RPO and billings would likely have compelled management to reduce annual revenue growth guidance to high single digit, which could be compromising to its headline-grabbing FY 2026 revenue target. To reach $50bn by FY 2026, Salesforce would need to generate sustained growth in the high teens from FY 2024 to FY 2026, absent acquisitions. Perhaps the markets already assumed it would fall short, hence the price reaction post earnings?

On the latest round of quarterly earnings calls, many technology companies have opined that economic conditions are going to get worse in the coming months and quarters. Corporate spend on IT projects pulled back the most in the third quarter of calendar year 2022, and expectations of the usual ‘budget flush’ in the fourth are muted.

It is uncertain if the current spending pause is going to end in weeks, months, quarters, or (God forbid) years. Software companies, even those selling mission-critical tools, are facing protracted deal negotiations and shorter contract durations, as customers - large and small - fear making large purchase commitments.

Salesforce has maintained that its deal pipeline is delayed, not lost. By postponing FY 2024 forecast till next year, is management hoping that business momentum will recover in the coming months, so that they can guide much better than high single digit? Or are they just taking a more measured approach, to gauge how various moving parts (both in the external environment and internal leadership changes) will land by the next earnings call in early March 2023?

Thoughts on Salesforce Prospects

Stock price movement and macro pressures aside, the key question for long-term investors is whether the investment thesis is still intact or broken. This extends beyond just FY 2026 targets. Will Salesforce continue to dominate and grow market share?

In the last few years, Salesforce has utilized its formidable balance sheet and high stock price to make bolt-on acquisitions and build a larger, deeper CRM platform. Now it is selling its comprehensive suite of products as Customer 360. Three strategic growth pillars were laid out at its recent investor presentation: (a) land-and-expand motion and multi-cloud adoption, (b) international markets, and (c) specialized offerings for 12 pre-selected industry verticals.

As a platform, Salesforce is no doubt a sticky one, as evidenced by its record low churns in Q3 2022 and proven cross-selling motion. The longer customers stay with Salesforce, the more cloud modules they appear to adopt.

Though recent macro pressures may have softened its near-term outlook, Salesforce still has a vast runway ahead, especially in EMEA and Asia, where digital transformations are not as far along compared to North America. Vertical solutions built on Saleforce - examples are nCino (NCNO 0.00%↑) for financial services and Veeva (VEEV 0.00%↑) for life sciences - also continue to scale faster, validating the depth of its platform.

Q3 2022 may not have given Salesforce much to cheer about, but the underlying growth engine appears to intact. Secular trends to adopt cloud-based solutions continue to be a tailwind, and Salesforce is a top software brand validated by marquee customers like AT&T (T 0.00%↑) and American Express (AXP 0.00%↑) worldwide.

Risk of competition is, however, a factor to consider. In fact, declining growth at Tableau may suggest customers opting for cheaper visualization tools offered by the likes of Microsoft ( MSFT 0.00%↑) and Oracle (ORCL 0.00%↑). This is something to watch out for, especially amid leadership turnover.

With the recent pullback in stock price, enterprise valuation has been reduced to less than $130bn. Assuming that it does hit its FY 2026 revenue target (or close to it) and produces an adjusted EBITDA margin of 30% - lower end of its profitability forecast - this implies a forward EV/ 26’ adjusted EBITDA multiple of only 8.5x, which is pretty low for a still fast-growing SaaS leader. Microsoft, another Dow 30 component stock but with a lower expected growth rate, trades at a higher multiple than that.

Things may be cloudy now for Salesforce, but when macro conditions stabilize and corporate spending normalizes, potential payoff from current stock price could be sharp.

(Author is long $CRM)

Join Consume Your Own Tech Investing to receive a welcome email with the following:

Latest Top 10 conviction Consumer and Tech positions in my portfolio

Book recommendations on investing, consumer and technology sectors

One article delivered into your inbox every Tuesday

Preview of upcoming articles

Follow me on Twitter @ConsumeOwnTech and Commonstock @ConsumeOwnTech