Tesla: Already Toast, or Still the Toast of Automotive Future?

Current market sentiment is reminiscent of 2018/2019, when everything seemed to be going pear-shaped. By Benjamin Tan

Happy new year. Especially to Tesla (TSLA 0.00%↑) long-term shareholders (myself included) who are wishing for a better year ahead than 2022.

When I started this blog in April 2022, the first post I wrote was on Tesla (“Tesla - Q1 2022 Results Confirm Hard Moats”). So, it seems apt to revisit the subject at the start of 2023. After all, Tesla is a hot topic (again) these days, with relentless media coverage on Elon Musk, his messy Twitter acquisition, endurance of demand in a recessionary environment, impact of higher interest rates, and more.

Always a bumpy ride with Tesla. I am just glad the cage fight between Elon Musk and Johnny Depp did not happen.

Changing Sentiment Even Among Hardcore Fans

I have been listening to Tesla Daily podcast on Spotify since 2019. I find it to be a great source of information, with extensive reporting ranging from updates on Gigafactories to detailed discussions of quarterly results. The host, Rob Maurer, is diligent in his reporting and comes across as a nice person too. He is a long-term shareholder, so he is biased, but he does exercise intentional objectivity on his show.

When Tesla share price started faltering in 2022, Maurer used to repeat how undervalued Tesla stock was at those levels. More recently, however, that sentiment has become less prominent on his show. Especially with Musk liquidating billions worth of Tesla stock on multiple occasions, even after assuring shareholders that no more would be sold after each disposal.

Current bearishness has spread to Tesla’s most ardent fans, except Cathie Wood of ARK Invest. She has balls of steel.

Repeat of 2018/2019: Momentum has Turned

I do not believe I have seen as much negative narrative since 2018/2019, when the whole $420 “funding secured” controversy was mixed with a make-or-break production ramp on Model 3. It was around the same time when Adam Jonas of Morgan Stanley issued a $10 (pre-splits) bear case, because he saw potential demand issues in China and it befitted the market narrative then. Jonas got a lot of press for issuing that report. And in the other corner, there was Cathie Wood on CNBC defending Tesla with her $4,000 price target. Most people thought she had lost her marbles.

Fast forward to today: here we are again. China demand problems. Elon Musk gone mad. Cathie Wood gone madder with even bolder projections. Bears are out in full force. A case of déjà vu.

I am waiting for Adam Jonas to come up with a new bear case any moment now.

So much about Tesla - the stock, CEO, that Cyberpunk Cybertruck, its vision - is polarizing. Musk thinks Tesla will be worth more than Apple AAPL 0.00%↑and Saudi Aramco COMBINED one day. Shorts love to bet on this stock because of the volatility. Many longs are Musk diehard fans: you cannot argue against undying love.

Near-Term Issues are Real

With a worsening macro backdrop, higher financing costs, and more competition (Rivian, Lucid, Ford, GM, Stellantis, Volkswagen, BYD, Nio, Hyundai) from all corners of the world, Tesla is feeling the heat. Current lineup of the latest electric vehicle models from other brands are matching Tesla in price, range, buzz, aesthetics, and power.

In the last few months, Tesla has had to cut prices multiple times to stimulate demand, especially in China where prolonged lockdowns have further complicated purchasing behaviors. Q4 2022 delivery numbers still fell short: full year 2022 deliveries (1.37mn) grew 40% instead of the guided 50%.

Perhaps for the first time ever, Tesla is facing demand issues; Musk had previously always maintained that Tesla was supply constrained.

Tesla: Sustainable Long-Term Advantages?

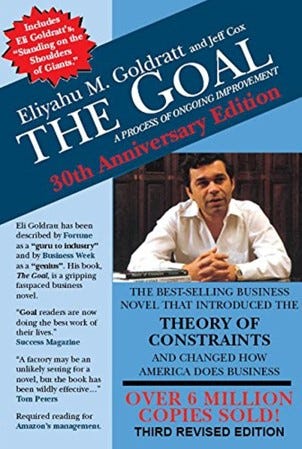

“The Goal” is a classic management book and required reading at many corporations. The takeaway for me after reading (and recommending it to my sister-in-law who runs a plant in South Carolina) is that manufacturing is hard. Very hard. Musk has said that ramping up Model 3 was a challenge so complex and large, it was unlike anything he had ever encountered before. Coming from a man who co-founded Paypal (PYPL 0.00%↑) and Space X, this statement highlights the potential challenges that await automotive makers who have yet to produce electric vehicles at scale.

Tesla’s institutional strengths at replicating large-scale manufacturing and integrated software development are unprecedented in the automotive industry. It is unlikely to lose that lead for a while, especially when it continues to refresh its lineup of vehicles, expand into new categories (Cybertruck and Semi) and further advance full self-driving capabilities.

That said, downside scenarios cannot be ignored. If Tesla is unable to keep those Gigafactories busy, many of its advantages are moot and the current share price cannot be supported. The silver lining is that Tesla’s balance sheet is rock solid ($20bn net cash) and it has already built out both Giga Berlin as well as Giga Austin. Any prolonged recession is more likely to eradicate smaller competition starved of easy money.

There are puts and takes on the current Tesla thesis. Personally, I have not sold a single share, but neither did I acquire more after my initial purchases in 2019. My husband, on the other hand, has been selling off some of his Tesla stake to de-risk. He does not hold the same regard for Tesla or Elon Musk as I do. In fact, he recently suggested buying a Rivian SUV. I shut him down, out of my allegiance to Tesla.

Ultimately, I may be a bigger Musk admirer than I care to admit. I want to see him and Tesla succeed, not just because I am a shareholder, but I resonate with their mission, accomplishments, and products.

From ground zero, Tesla has paved the way for rapid commercialization of electric vehicles in the last decade, overcoming countless challenges (including production, supply chain constraints, battery technology barriers, logistics, software, lawsuits, regulatory hurdles) to become the bestselling electric vehicle maker in the world. Through vertical integrations, clever engineering and a direct distribution model to customers, the company has produced some of the highest gross margins in the entire automotive industry:

While current price cuts will reduce profitability in the coming quarters, Tesla’s lower margins still exceed Toyota’s, often regarded as the most efficient carmaker in the world. I believe Tesla possesses sufficient human ingenuity, capital efficiencies and structural advantages to work its way through the tough macro environment.

Therein lies the rub: I still trust Tesla as a corporation to break new ground and create value for all stakeholders. But trust is very subjective. I can understand how recent events might have eroded trust for some in Tesla management (read: Elon Musk). Unless one is adopting a literal coffee can approach to investing, it is easy to cash out on stocks with just a few clicks on the smartphone.

To me, Tesla is far from toast. Despite near-term pains, secular trends and clear competitive advantages continue to favor Tesla. But I am not toasting to Elon Musk or Tesla either, and will continue to be cognizant of any fundamental threat to the long-term thesis.

So, I shall be watching Tesla. And praying that Elon Musk does not end up in a cage fight with Johnny Depp.

(Long TSLA 0.00%↑)

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

Latest Top 10 positions in my high conviction portfolio that combines value with growth stocks

Book recommendations on investing, consumer and technology sectors

One article delivered into your inbox every Tuesday

Preview of upcoming articles

Follow me on Twitter @ConsumeOwnTech and Commonstock @ConsumeOwnTech