Topsy-Turvy Markets: A Nightmare, Especially for the Perfectionists in Us

Perhaps it is time to stop reading macro tea leaves? By Benjamin Tan

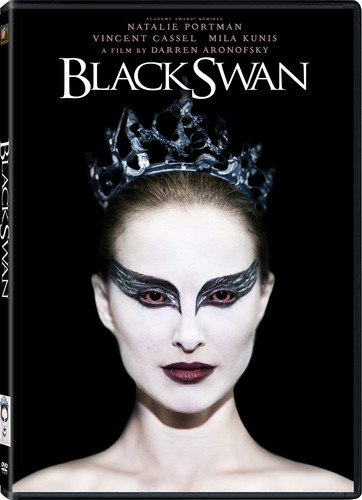

Ever watched the 2010 movie Black Swan starring Natalie Portman? She plays Nina Sayers, whose singular goal is to secure the lead in the production of Swan Lake and give a perfect performance. It is a role to die for – literally. Sayers yearns for perfection and exercises tremendous effort in her practice to achieve it. But in one memorable scene, her artistic director Leroy dismisses her rigor:

“Perfection is not just about control. It's also about letting go. Surprise yourself so you can surprise the audience. Transcendence.”

Sayers does achieve transcendence at the end of the movie, after embracing her untamed self. It comes, however, at a great personal cost due to the torture she puts herself through.

Fixated on Market Gyrations

Like Nina Sayers obsessing over her performance in Swan Lake, many investors are fixated on their stock portfolios. We want to know what is going to happen and we work hard to look for clues. As volatility continues, every economic indicator is scrutinized for signs of future directions. Is the economy going to become worse? Have we bottomed yet? Is Facebook ($META) dead?

We need to know when we can emerge victorious at the end of this market chaos. But what if there is no end to this volatility? What if the more one agonizes over unknown market and economic outcomes, the more counterproductive one becomes?

Nobody Knows What is Going to Happen…

Investor sentiment seems to be in the doldrums now, especially when interest rates continue to rise. To curb inflation, the Fed is open to unleashing more pain on the economy.

So what is going to happen to the stock market? In the words of William Goldman, the Oscar-winning screenwriter, nobody knows anything.

People - whether an economist, CEO or retail investor - can only speculate.

Black Swans are the Kryptonite to Perfectionists

There is a perfectionist in each one of us, and that trait compels one to focus on deriving the ideal outcome. Investment results are often beyond our control - we can only do so much due diligence to ensure that we remain informed, but Black Swan events abound. Think back to early 2020 when stock markets worldwide started to crumble under the weight of Covid-19 fears and non-stop news of impending apocalypse.

Unexpected, unpredictable and ugly, Black Swan events are also part of investing. There is no running away from them. The more we try to exact control over investment outcomes, the worse we will feel when the unanticipated happens.

Investing: Order and Chaos

Just like Nina Sayers has to accept both her inner White Swan and Black Swan, investors need to embrace both order and chaos. We maintain orderliness in our investment processes by being methodical to evaluate existing and potential investments. We remain organized in detecting shifting tides that may render certain sectors or companies more or less relevant to match our portfolio exposure. Reviewing quarter results is hence essential for all stock investors. Having the right capital deployment discipline - especially on the price we pay - is also key to long-term success.

Other than that, we should let go and accept the chaos that come with any equity exposure. Hedging may be employed to mitigate volatility, but it does not exclude it. In fact, any form of asset investment is subject to some degree of fluctuation - the difference is how much media coverage (read: noise) each one gets from the likes of CNBC.

The Pareto principle states that 80% of outcomes are driven by only 20% of variables. Meaning, most variables just do not matter. To obsess over everything will only drive us mad. All we can do to reduce systematic risks is to diversify our portfolio and hold a mix of asset classes with different risk profiles.

Examining the Psychological Impact of Seeking Perfect Outcomes

The 2010 film Black Swan lends a somber look at quest for perfection. The urge to stick that perfect ten landing is in all of us, but when it overtakes all consciousness, it can become myopic and harmful.

With companies announcing quarterly results in the coming weeks, perhaps focusing our attention on those will be a better (and healthier) use of time. As long as we are not facing apocalypse, many companies will continue to survive, or even thrive in this new economic environment. Here is a quote from Warren Buffett:

“In its brief 232 years of existence, however, there has been no incubator for unleashing human potential like America. Despite some severe interruptions, our country’s economic progress has been breathtaking”

Sure, some with balance sheet constraints and weak cashflows may not survive, but the best ones will adapt and innovate their way out of this. It is therefore our job as investors to identify which investee companies have the innovative prowess, capital, and fiscal discipline to emerge from this period of upheavals. Forget reading macro tea leaves.

So keep calm and carry on.

Follow me on Twitter @ConsumeOwnTech

Join Consume Your Own Tech Investing to receive a welcome email with the following:

Latest Top 10 conviction Consumer and Tech positions in my portfolio

Book recommendations on investing, consumer and technology sectors

One article delivered into your inbox every Tuesday

Preview of upcoming articles

Follow me on Twitter @ConsumeOwnTech

Also, check out Daily Market Briefs, a fast growing daily newsletter that brings 16,000+ readers up to speed with the top finance and business stories around the world in under 1 minute!