Unity: Metaverse, Interrupted?

A Late-Stage Jenga Ad-Stack Threatens to Befall on Unity’s Story

History of Advertising Business at Unity

Unity ($U) is the dominant software engine for mobile games, but a substantial portion of its current revenue is derived from advertising, which is organized under its Operate Solutions segment. Advertising did not even exit in the first decade of Unity’s corporate life, which began in 2004 as a gaming company. It only shifted into gear when John Riccitiello joined the company as CEO in 2014. Riccitiello, having come from video game company Electronic Arts and private equity firm Elevation Partners, made a few transformational acquisitions to extract advertising dollars from its increasingly popular game development platform. It was a strategic pivot that paid off in spades. By FY 2021, Operate Solutions (of which advertising is a majority component) brought in $709 million, or 64% of Unity’s total annual revenue.

Audience Pinpointer — A Late-Stage Jenga

When Q1 2022 results were released, however, Operate Solutions revenue was kneecapped by suboptimal performance of its targeting tool, Audience Pinpointer. Less accurate targeting equals lower ROI, leading to reduced advertising spend. On the earnings call, Audience Pinpointer sounded like a late-stage Jenga — too much focus on scaling new heights, with too little attention paid to its resiliency.

As result, it will take Unity the rest of this year to fix the issue. The cost? An estimated $110 million in revenue loss. Already in Q1 2022, Operate revenue growth slowed to a 26%, compared to 40% in Q1 2021.

Share price cratered, and Unity is now in a penalty box. But should it be?

Dominant Real Time 3D Engine: Gaming and Non-Gaming

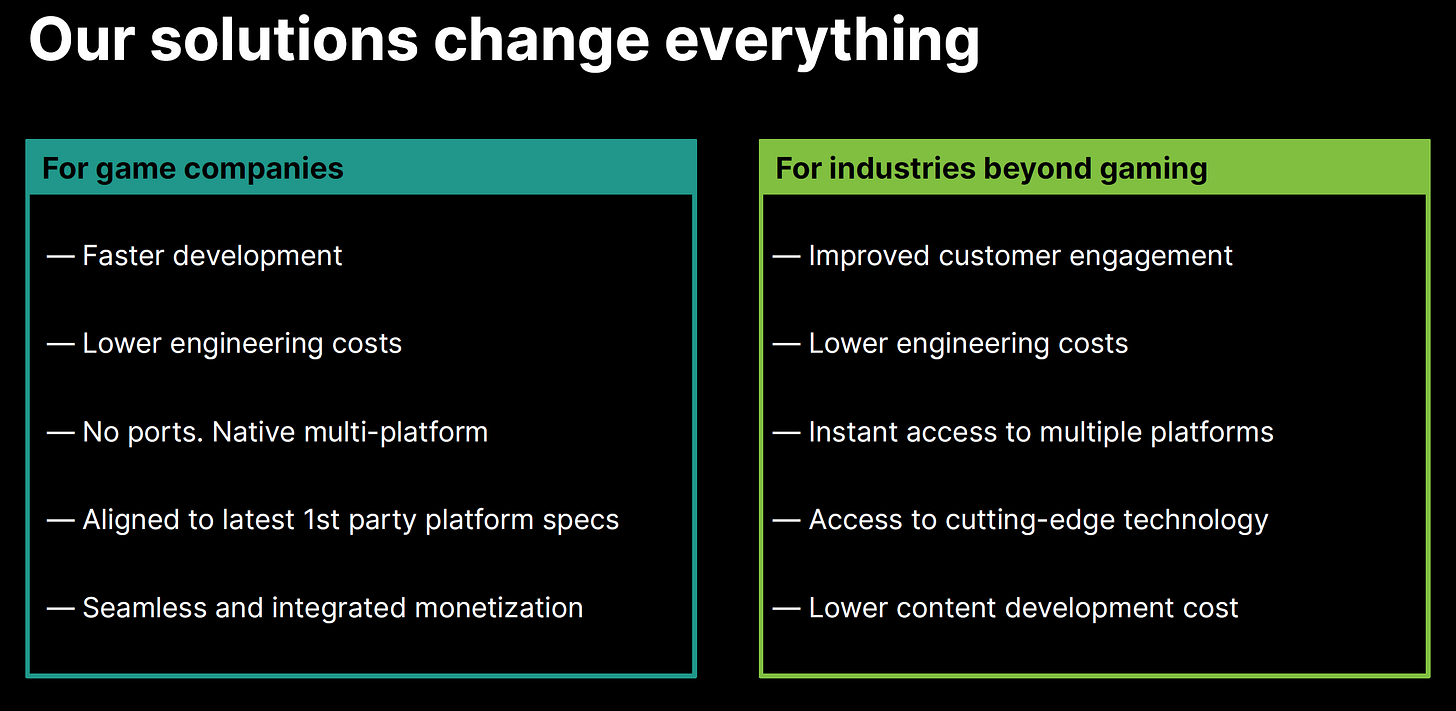

Since its IPO in September 2020, Unity has been touted as the next generation creative software giant, with a versatile game engine that can be repurposed for non-gaming verticals to create 3D worlds across multiple use cases.

That picture has not changed, even with its advertising woes. Acquisition of Weta (closed in Q4 2021) has augmented Unity’s technological depth. Create Solutions enjoyed a strong 65% growth in Q1 2022, albeit some of it was contributed by Weta acquisition. Unity continues to gain grounds outside of gaming, in areas like architecture, engineering, construction, advanced simulation, manufacturing, automotive, and high-end luxury. Immersive technologies will be the primary way to do design work going forward, and Unity is the one to beat.

Unity: Still at the Core of the Metaverse Movement, and Jenga can be Rebuilt

Unity remains the dominant development software for mobile games and offers creators a one-stop shop for monetization opportunities, including advertising. Unity Ads is a convenient checkbox for game developers at the creation stage. Despite snafus with Audience Pinpointer, Unity benefits from having 4 billion monthly active users powering its analytics and contextual models. Apple’s privacy changes led Unity to a relative competitive advantage, as advertising networks dependent on identity became relatively weaker, and Unity’s contextual standards stronger. These advantages do not disappear overnight.

Growing pains, especially after rapid scaling in FY 2020 and 2021, are unavoidable. Advertising business is still new, relative to Unity’s almost 20-year corporate history. While topline projections have come down, and profitability pushed out as a result, long-term picture of Unity as the next-generation creative software is intact.

Mobile game developers continue to prefer Unity, with its modular system for easy game building, better user interface than Unreal, plug-and-play features, and an asset store to be enhanced further by Weta acquisition. Unity also offers a rich toolchain for non-gaming creators across multiple industries to create real-time 3D content. Unity already counts Microsoft (HoloLens), BMW, Apple, eBay and Facebook as customers. Its technology is well supported and documented, positioning Unity right at the core of the metaverse movement, both in gaming and non-gaming. This is a multi-billion dollar opportunity, and should remain the crux of Unity’s story.

As for the current progress of restoring Audience Pinpointer, below may provide some indication:

An interview conducted in early-May 2022 with a gaming company describes recent user experience with Unity’s auto bid system as buggy, leading to poorer performance in the preceding months. But the gaming company also notes that restorative efforts by Unity could solve the issues by next quarter.

With the level of technological depth at Unity, it is inconceivable that they do not have the capabilities to fix Audience Pinpointer. Advertising dollars are loyal only to ROI and reach. Barring macroeconomic factors, once Unity’s ad-stack is rebuilt, they will come back. Unity is still a leader in the gaming ad network triopoly with ironSource and AppLovin — it is hard for competition to match the contextual data of 4 billion MAUs coming from its symbiotic game development platform.

Creators across industries continue to grow with Unity, where technologies to engineer tomorrow’s metaverse are only getting stronger. So should investors looking farther into the horizon of what Unity can become — well beyond the current scuffle over pieces of promiscuous advertising dollars.

(Author is long $U)

Subscribe to Consume Your Own Tech Investing to receive a welcome email with the following:

Latest Top 10 conviction Consumer and Tech positions in my portfolio

3 book recommendations on investing, consumer and technology sectors

One article delivered into your inbox every Tuesday

Preview of upcoming articles

In addition, you will receive a Subscriber-Only emails with updates to my portfolio convictions and latest recommendations on books to read.

Follow me on Twitter @ConsumeOwnTech