Unity Software: Q2 2022 was a Tale of Two Cities

Create Solutions thrived but Operate Solutions was hit by weaker ad revenues. By Benjamin Tan

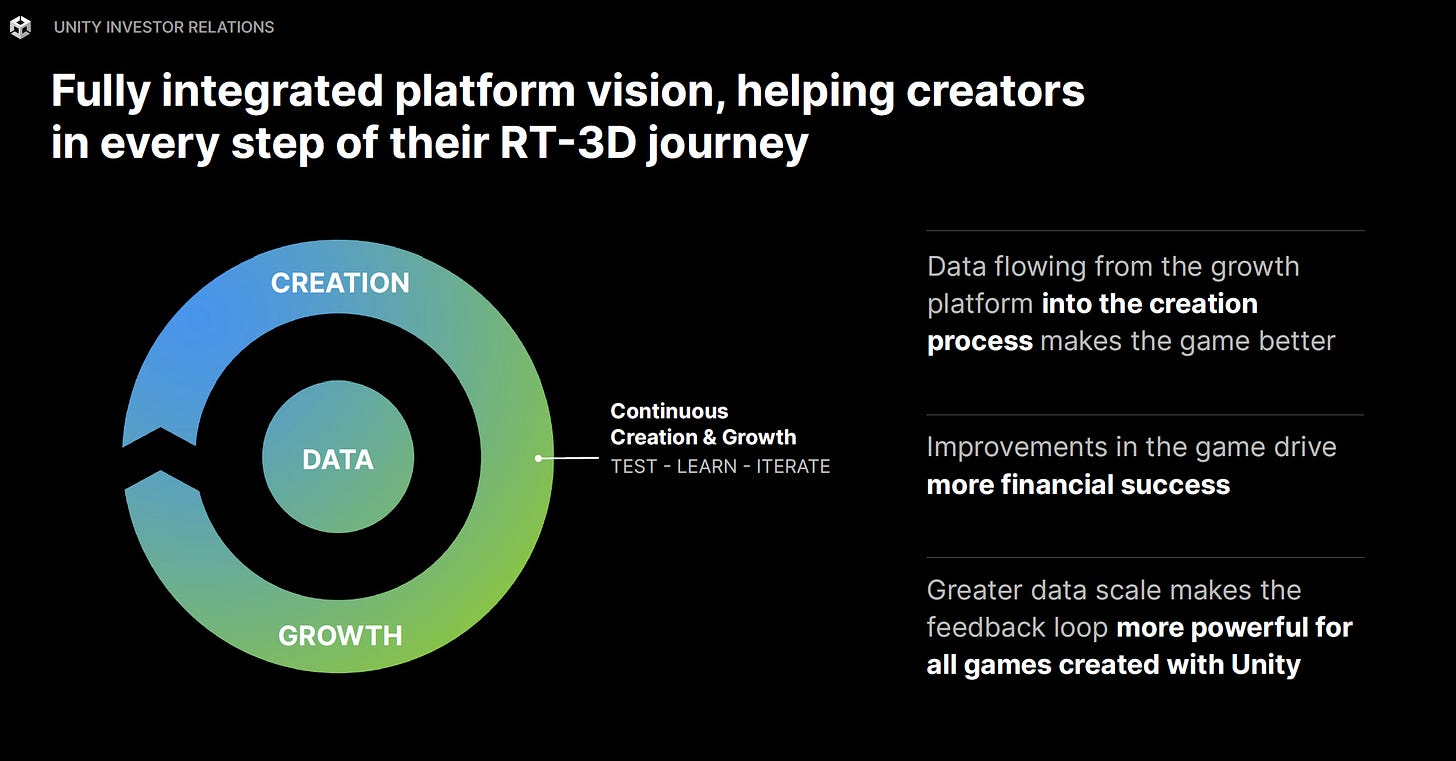

Following the last write-up on Unity ($U), the company announced an all-stock transaction with ironSource ($IS). The acquisition, if approved and consummated, would put AppLovin ($APP) in a weaker competitive position, given that the three entities form the gaming ad network triopoly, and size matters. No wonder AppLovin tried to stop the move by offering to acquire Unity instead. It is likely that the Unity-ironSource deal will go through, paving the way to bring Unity’s Create Solutions to ironSource, and ironSource’s SuperSonic and mediation capabilities to Unity. The combined duo would have an even greater data advantage to help game developers with the entire end-to-end process, from creation to monetization:

On Q2 2022 results, Create Solutions accelerated revenue growth to 67%, achieving greater success with both gaming and non-gaming businesses:

“We are encouraged by the performance in the Games business. The second quarter of 2022 was our biggest games quarter end….Unity is much more than games now as our growing success outside of games attests. Our business outside of games represented 25% of our total Create business for the full year of 2021 and 33% for the fourth quarter of 2021. At the end of the second quarter 2022, our business outside of games represented 40% of our total Create business. And remember, this mix expansion is within the context of having our best revenue quarter ever for our gaming business”

The crux of the Unity investment thesis has always rested on its platform becoming the next generation creative software giant, with a versatile game engine that can be repurposed for non-gaming verticals across multiple use cases. Q2 2022 results reaffirmed further progress in that direction, with management offering some exciting proof points:

Continues to be the dominant mobile game engine, with more than 70% of the top mobile games created on Unity

Nearly half of the streaming games for PC were made with Unity in 2021. In May 2022, 13 of the top 20 most popular ones originated from Unity

Unity made up 80% of the most popular VR games on Oculus Quest in July 2022

Announced strengthened partnership with Mercedes/Daimer to deploy Unity’s real-time 3D engine technology to power the infotainment system across all Mercedes-Benz AG product lines

Announced partnership with Capgemini to jointly define and execute sector-specific solutions and professional services, to deliver tailored platforms focusing on use cases across consumer goods & retail, manufacturing,

life sciences, telecommunications, media & technology, energy & utilities, financial services, and public services

Audience Pinpointer Fixed, but alas, Macro Sucks

During the second quarter of 2022, the macro environment played a significant part in dragging down revenue growth across the entire advertising sector, including social media, Alphabet ($GOOG) and connected television. Unity’s Operate Solutions was not spared, printing a 13% year-on-year revenue decline. Results were exacerbated by Unity’s technical targeting issues. While those were solved by the time Q2 2022 results were announced, return of advertising dollars were more delayed than what management had expected.

Consequently, Unity’s consolidated revenues, gross profit margin, retention metrics and growth of $100,000 customer cohort, were all pulled down by the suboptimal performance at Operate Solutions. Annual revenue guidance for FY 2022 has been further reduced to better manage expectations, given the dynamic nature of programmatic advertising:

“The full year guidance reduction is driven by recent negative macroeconomic factors and the complexity of accurately forecasting the timing of the changes in trajectory of the monetization business. We believe that the $50 million range in our full year guidance is appropriate given the uncertainties in the ad market…We have fixed the data challenges that we discussed last quarter and are launching new features. We are seeing improvements in our products with lead indicators such as Audience Pinpointer accuracy, showing our innovations are effective…We continue to invest to strengthen our products with additional features that we expect will get our third and fourth quarter through stronger footing”

Catalysts to Watch for H2 2022 and Beyond

Unity’s struggles with advertising dollars bear some watch, though Operate Solutions is likely to return to strength towards year-end, when seasonal spend in advertising is at its highest. Merger with ironSource presents strategic opportunities for Unity to take further market share within the Create and Operate Solutions segments; FY 2023 will be the year to watch, if management can deliver on those synergies.

Meanwhile, Unity continues to ride high on its Create Solutions, especially with AR/VR and cloud gaming providing further growth opportunities. Outside of gaming, Unity remains the one to beat, as more companies look to leverage real-time 3D models across multiple sectors with increasing use cases.

(Author is long $U)

Subscribe to Consume Your Own Tech Investing to receive a welcome email with the following:

Latest Top 10 conviction Consumer and Tech positions in my portfolio

3 book recommendations on investing, consumer and technology sectors

One article delivered into your inbox every Tuesday

Preview of upcoming articles

In addition, you will receive a Subscriber-Only emails with updates to my portfolio convictions and latest recommendations on books to read.

Follow me on Twitter @ConsumeOwnTech