Project 350K: A Review of My 2025 Traditional IRA Performance

What worked, what didn’t, and how I am adjusting for 2026. By Benjamin Tan

At the beginning of 2025, I set a goal for my Traditional IRA: to grow it to $350,000 over a 10-year period, as outlined in parts 1, 2, and 3. Since I already have most of my net worth invested in lower-volatility assets such as real estate and large-cap stocks, this account allows me to adopt a more aggressive investment posture. Meanwhile, statutory contribution limits naturally restrict the amount of capital deployed—a useful constraint given my Type 5 tendency to gravitate toward niche, smaller-cap companies and to risk overconcentration.

Reaching $350,000 over ten years implies a roughly 14% annualized return. That target was intentionally aggressive, designed to test both my investing process and my discipline. With the benefit of hindsight, 2025 provides the first meaningful data point on how that process performs under real-world conditions.

Hard Facts: Performance and Key Drags

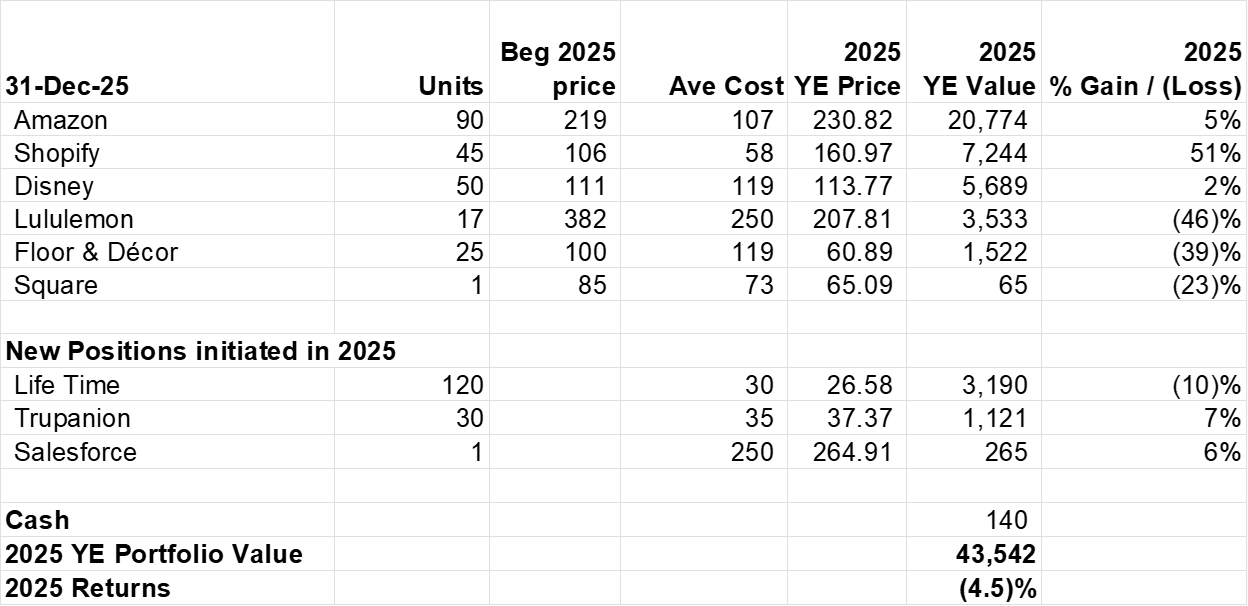

As of December 31, 2025, the account stood at approximately $43,500 after receiving the maximum annual contribution of $7,000. The portfolio declined 4.5% for the year. By comparison, the S&P 500 returned 18%, and the Nasdaq rose 21%.

Here is a breakdown of the portfolio at year-end 2025:

The primary contributors to underperformance were a lack of meaningful appreciation in Amazon AMZN 0.00%↑, which rose just 5%, and a significant drawdown in Lululemon LULU 0.00%↑ over the course of 2025. Neither position was actively traded during the year; performance reflected market movements.

The drag was partially offset by a roughly 50% gain in Shopify SHOP 0.00%↑. However, that was more than offset by a poorly timed position in Globant GLOB 0.00%↑, which resulted in a material loss during 2025.

Globant GLOB 0.00%↑ warrants specific attention. I initiated the position early in the year, added shortly thereafter, and ultimately exited the entire stake by August at a loss. While the capital at risk was contained, the sequence highlighted a recurring issue: adding to a position before sufficient evidence had accumulated to support the thesis, and holding on longer than warranted as fundamentals deteriorated.

The Central Lesson: Pacing Matters More Than Ideas

The most consequential takeaway from 2025 was not stock selection but capital deployment, as my mid-year review made clear. I allocated the majority of my annual contribution in the first quarter. When volatility increased and opportunities improved later in the year, flexibility was limited.

Front-loading capital reduced optionality and increased sensitivity to early-year misjudgments. In contrast, positions initiated later in the year—such as incremental additions to Life Time LTH 0.00%↑ and Salesforce CRM 0.00%↑—benefited from better entry points and clearer operating signals.

Portfolio Structure Observations

The portfolio remains concentrated, with only a handful of positions carrying most of the weight. This remains a work in progress. Over time, I expect the account to hold roughly 12–15 positions, each with an allocation of approximately $5,000–$7,000, focused on businesses with operating leverage and durable brand or platform moats.

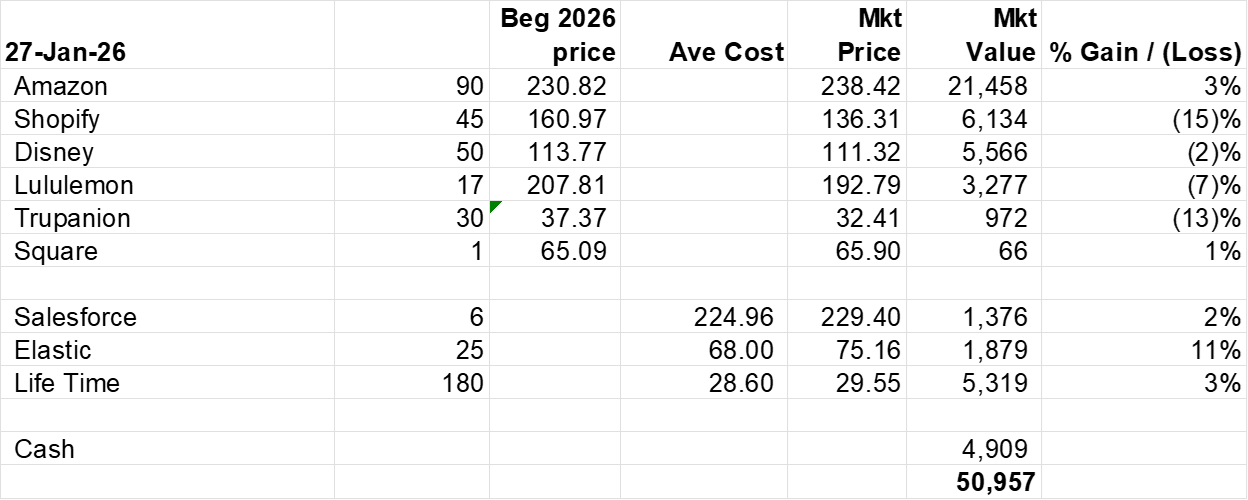

One structural adjustment I am introducing in 2026 is the selective use of opportunistic trades to enhance returns. With Amazon AMZN 0.00%↑ representing roughly half of the portfolio, achieving alpha is difficult unless it materially outperforms the market. To compensate, I will selectively deploy capital into shorter-duration opportunities in companies I know well from my trading account.

This thinking led to a position in Elastic ESTC 0.00%↑ in January 2026, funded by selling a legacy position in Floor & Decor FND 0.00%↑. I have followed Elastic for years and previously held a position there profitably before exiting in 2024. Currently, Elastic trades near 4x EV/Sales, making it both a recovery candidate and a potential acquisition target. This position is sized accordingly and assessed on a different time horizon than my core holdings.

With additional purchases in Life Time LTH 0.00%↑ and Salesforce CRM 0.00%↑ completed in January, along with the Elastic ESTC 0.00%↑position, capital deployment for Q1 2026 is complete.

Looking Ahead to 2026

Based on the 2025 experience, my focus for 2026 is as follows:

More deliberate pacing: Capital will be deployed more evenly across quarters.

Anchor stock: Amazon AMZN 0.00%↑ remains the portfolio anchor. While it may dampen upside in strong markets, it provides stability and scale.

Long-term conviction holdings: Life Time LTH 0.00%↑, Salesforce CRM 0.00%↑, Shopify SHOP 0.00%↑, Lululemon LULU 0.00%↑, and Disney DIS 0.00%↑ remain core positions, subject to further top-ups but capped at $5,000–$7,000 each.

Positions under evaluation:

Square $XYZ remains a meaningful holding in my trading account, but it is a small position here, resulting from deploying excess cash before Project $350K took shape. Although it has underperformed, recent management guidance indicates accelerating gross profit growth. While I identified this company as a potential multi-bagger as early as 2022, the stock and its underlying financial performance struggled in recent years. I will revisit this position in the coming quarters, mainly to adjust risk appropriately for my trading account.

Trupanion TRUP 0.00%↑ is another re-entry after a profitable prior investment. The pet insurance market continues to grow, though topline growth has slowed to the low-teens. This position will be reassessed following Q4 results and 2026 guidance.

The original $350,000 target remains intact, but it is best viewed as an outcome rather than a mandate. Achieving it will require favorable market conditions, disciplined execution, and time. More importantly, success depends on building a repeatable process that limits large errors and preserves upside when conditions improve.

2025 did not deliver outsized returns. It did, however, deliver clarity. In a multi-year project, that may be the more valuable currency.

My book, Suit Yourself: A Portfolio Strategy for Every Personality Type, blends Enneagram psychology, pop culture, and behavioral finance to offer a personalized roadmap to investing. Learn more at my author page or order the book on Amazon. Follow me on X.com (formerly Twitter) @ConsumeOwnTech and Yahoo Finance.

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

My Top 10 high-conviction portfolio positions, combining value and growth stocks

Book recommendations in investing, consumer, and tech sectors

Monthly articles delivered straight to your inbox