Tesla: Key Broker Takes on Q3 Production and Deliveries

Expectations were already lowered but actuals still disappointed. By Benjamin Tan

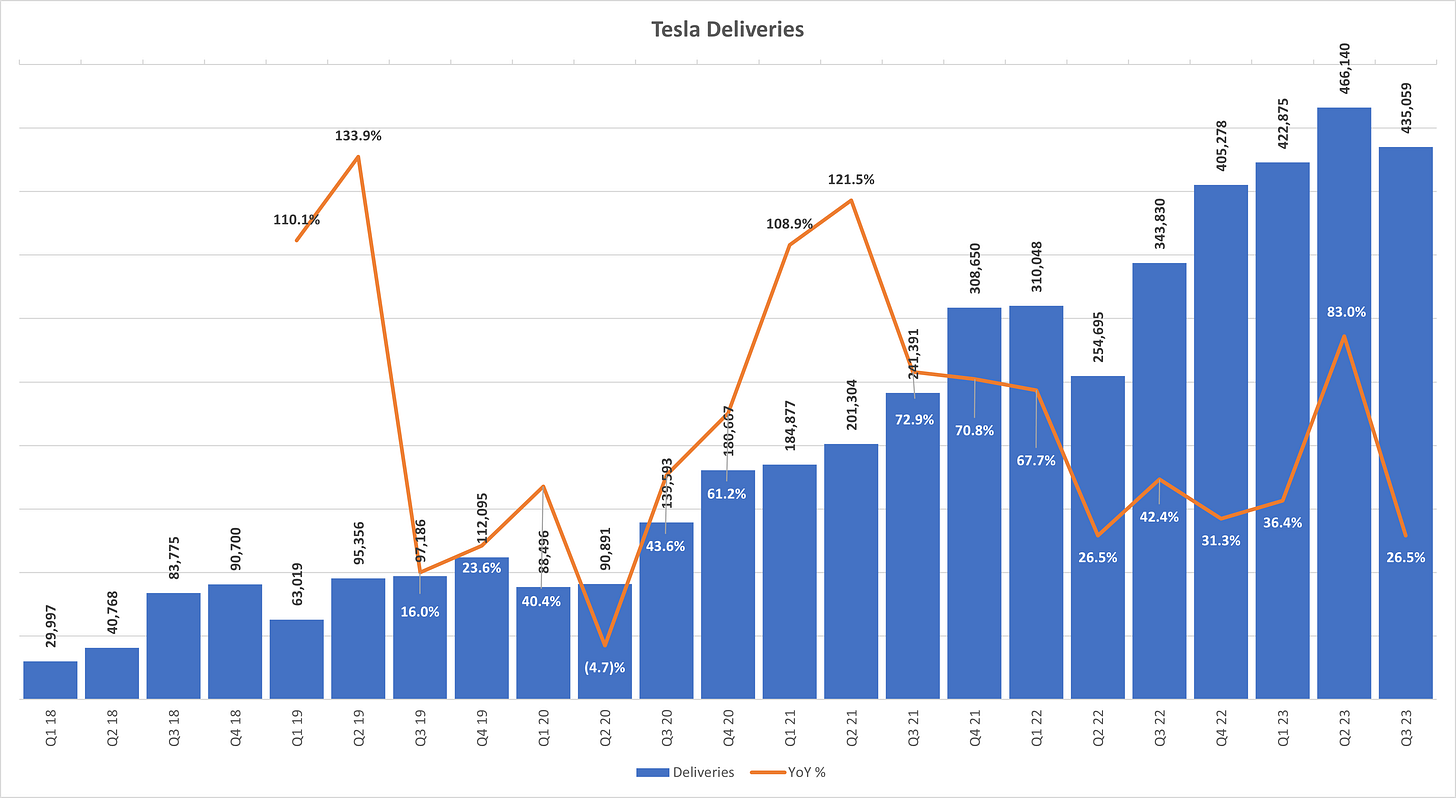

Tesla TSLA 0.00%↑ produced over 430,000 vehicles and delivered over 435,000 cars in Q3 2023. Numbers came in lower than expected, despite advanced notice from management on the planned factory downtimes, mainly due to the Model 3 refresh during Q3.

Year-on-year growth rates amounted to 18% and 27%, respectively. Under current economic conditions, these numbers are impressive, albeit below their 50% CAGR long-term guidance and Q2 levels.

FY 2023 production is still targeted at 1.8mn. I wonder if Elon will repeat his aspiration for 2mn on Oct 18, when Tesla hosts its Q3 earnings call. The descriptor “around 1.8 million” in yesterday’s announcement is causing some concern that Tesla may fall short of the baseline volume guided.

More importantly, what will FY 2024 look like? On the one hand, Cybertruck will be a meaningful addition, with pre-orders already exceeding 2mn; conversely, much will also depend on the demand environment next year.

See Tesla’s quarterly delivery trends since Q1 2018:

Margins, Margins, Margins: Now What?

With lower production volume this quarter, Tesla would have had to extract greater cost discipline in Q3 to maintain their 18% automotive gross margins (excluding regulatory credits) from Q2.

This appears unlikely, especially given more price cuts in recent months.

Nevertheless, Tesla remains fundamentally well-positioned in the electric vehicle race—see below a past article I wrote about its enduring competitive advantages:

Further Color from Goldman, Deutsche Bank, and Morgan Stanley Research

I have compiled some snippets from the above research houses to provide additional color on Q3 production and delivery numbers and what they may imply:

From Goldman Sachs (Oct 2): “3Q23 deliveries first take”

While we reduced our 3Q23 volume estimate in our 9/17 note to 460K to better reflect what we believed was lower S/X demand and the impact of the changeover for the Model 3 Highland, 3Q23 deliveries were lower than we had expected…We believe key debates will now shift to:

1) What is the margin impact in 2H23 from the reduced production levels (recall that last quarter Tesla's non-GAAP automotive gross margin ex. credits was 18.1%, and the lower production/deliveries and price cuts imply 3Q will be down sequentially).

2) To what extent new models (Model 3 Highland, Cybertruck) can help drive stronger volumes in 4Q23 and 2024. Consensus per Visible Alpha Consensus Data is at 499K in 4Q and 2.358 mn in 2024. We model a pick-up to 494K in 4Q and 2.275 mn in 2024, in line to modestly below the Street.

3) Price-cost in 2023 and 2024. We expect Tesla to benefit from lower costs in 4Q23/2024, although we believe that it may further lower prices to drive volume next year and mitigate margin improvement.

4) Tesla's opportunity and timelines with technology and new products, including FSD. We see Tesla as a leader in autonomy technology, although we think it will take time for Tesla to be able to offer an eyes-off and hands-off (L3/4) capable vehicle.

From Deutsche Bank (Oct 2): 3Q Deliveries a slight miss, expect large risk to 2024

To us, we think the more meaningful downside risk is to 2024 consensus due to limited volume growth next year and minimal Cybertruck contribution…we continue to see larger risk to downside to expectations for 2024 on both growth and earnings, as Tesla indicated recently at our DB IAA investor meetings that it is no longer planning to expand output at Austin and Berlin factories to 10k per week, providing only incremental volume from these two factories next year as well as minimal contribution from the Cybertruck with slower and more complex ramp-up of the vehicle. Our base case is for Tesla to guide to ~2.1m deliveries next year, vs. current Consensus of 2.3m units.

From Morgan Stanley (Oct 2): 3Q Delivery Miss + A Warning On ‘Too Fast’ EV Adoption

While the company cited disruption related to planned downtime for factory upgrades (Model 3 refresh) we believe investors will remain cautious on the near-term progression of price (downward) as supply of EVs exceeds demand in key pockets. Our current forecasted US GAAP OP margin (SBC burdened) progression for Tesla in 3Q and 4Q is 9.6% and 9.8% respectively. This compares to 10.5% in 1H23 and 16.8% in FY23. Looking ahead to FY24, we forecast approx. 33% growth in deliveries to 2.48mm units. On our calculations, removing 100k units from this figure at a 30% decremental margin would be worth between 9 and 10% of total company GAAP OP.

(Author is long TSLA 0.00%↑)

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

Latest Top 10 positions in my high conviction portfolio that combines value with growth stocks

Book recommendations on investing, consumer, and technology sectors

Articles are delivered to your inbox on Tuesdays

Preview of upcoming articles

Follow me on Twitter @ConsumeOwnTech and Commonstock @ConsumeOwnTech