Enneagram x Stock Picking (Part I): Type One Perfectionists

Why Do We Invest in Individual Stocks? It is not just about "Beating the Street" because individual motivations can vary significantly. By Benjamin Tan

There are countless books on the subject of stock picking. Two of the most popular ones - “One Up on Wall Street” and “Beating the Street” - are written by famed fund manager, Peter Lynch. Their titles may be designed to incite the competitive spirit in readers, dangling secrets that offer potential advantages to beating financial professionals and market benchmarks. Both books have sold well. How many readers have actually managed to one up and beat the street is an unknown.

A desire to win out, however, is not the defining characteristic that drives all investors to buying individual stocks. Some are drawn more to the learning process of performing due diligence on individual companies, while others may be gamblers in disguise, seeking that adrenaline rush. Different strokes for different folks. More precisely, examining underlying motivations in investing behaviors can be facilitated with reference to a personality typing tool known as the Enneagram.

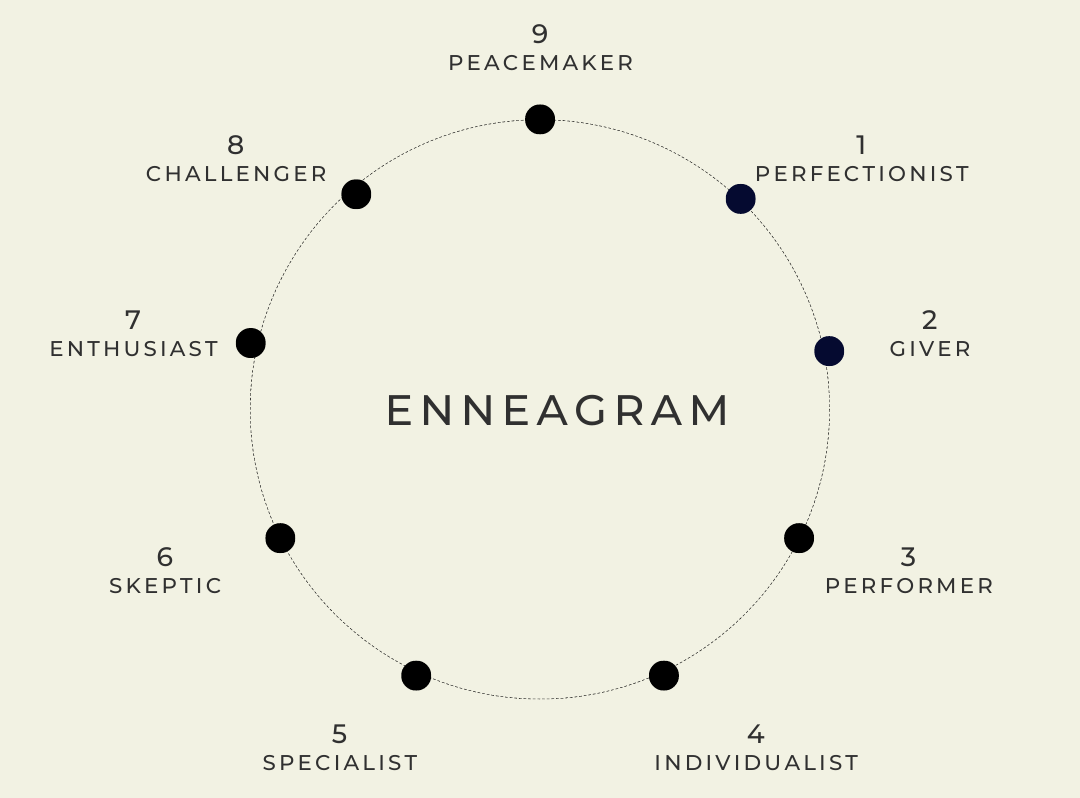

Enneagram: Multiple Motivations Driving Different Personalities

As a believer in self-help, I have found the Enneagram to be useful for my self-awareness. It offers one of the best psychological frameworks for introspection because it looks beneath the surface of human manners to explore the underbellies. By dividing personalities into distinct archetypes, it also allows for easier recognition of self and others.

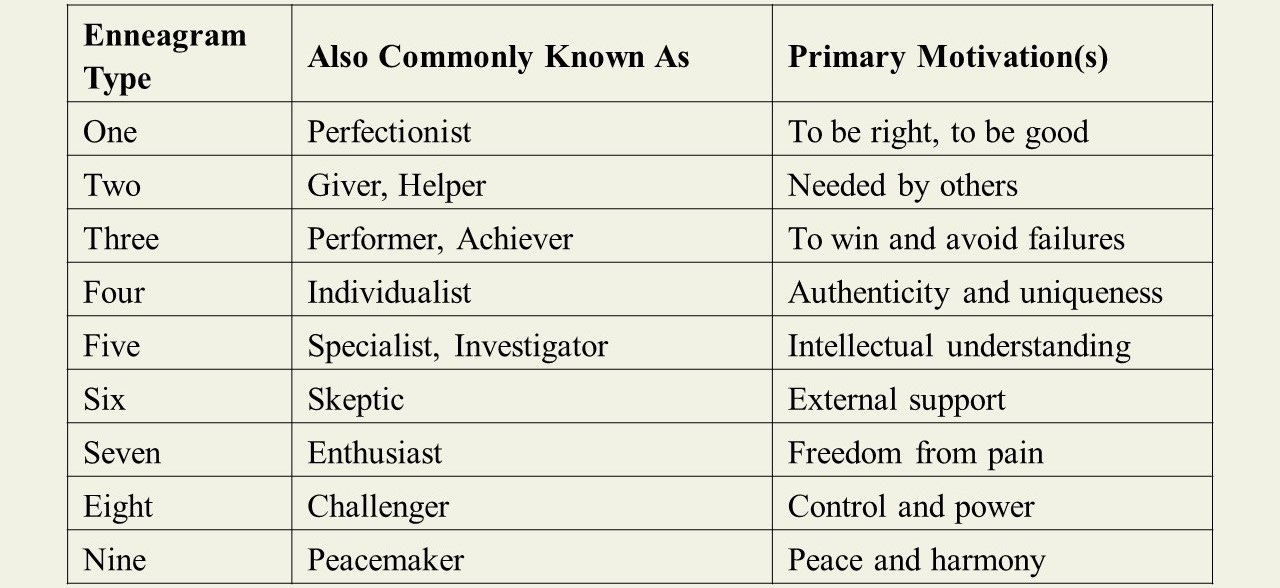

Below are the primary motivations associated with each Enneagram type:

Enneagram x Stock Picking: Revealing Reasons Why People Invest

Warren Buffet has always favored low-cost index funds for investors. Back in 2008, he even placed a million-dollar bet against a hedge fund manager that the S&P 500 would outperform a portfolio of hedge funds over 10 years. Buffet won that bet by a landslide in 2018.

Still, many investors - myself included - choose to at least dabble in stock picking, with varying results. A cursory look at Twitter reveals many popular accounts that dispense wild predictions on which companies are headed for the pantheons of glory, and which ones will be joining the likes of Bed Bath and Beyond (BBBY 0.00%↑) in the corporate graveyard. Stock picking continues to rule our consciousness and attract more participants.

I have been studying the Enneagram - and practicing as a coach out of interest - for more than a year now, and I find its applications to be highly versatile. More recently, I have observed connections between the typology and investing behaviors. Below, I shall describe the first archetype - Perfectionists - with the remaining eight to be featured in upcoming articles on this blog.

Type One: Perfectionists

Type One Perfectionists care about details, and their approach to investing is meticulous, reliable, and methodical. On the other hand, their fondness for order and predictability is almost a philosophical misfit with the uncertainty that comes with investing.

Type Ones tend to gravitate towards companies that are stable in nature, such as real estate investment trusts and large-capitalization stalwarts. Rules on valuation metrics and quality of earnings are imposed in strict order when filtering for opportunities. Unproven, loss-making high-growers (think technology and biotech) are unlikely to be their cup of tea. Type One investors are motivated by adherence to their evaluation frameworks and standards.

Being a perfectionist can be an incredible source of discipline and strength in personal investing. They crave definitiveness and are great at following investment methodologies to a tee. Type One investors are built for the kind of intense due diligence that leaves no stones unturned.

However, a desire for precision can become a hinderance and cause one to lose sight of the forest for the trees. Economist John Maynard Keynes once stated, “It is better to be roughly right than precisely wrong.” The impulse to get details straightened out and polished is second nature to Type One investors, but if left unchecked, could misdirect energy to seeking exactness at the expense of taking actions based on approximations of the bigger picture. Allowing the illusion of completeness to determine the course of investment actions – just because it checks all the boxes – can also lead one to precisely the wrong direction, like value traps.

We can only do so much due diligence and establish so many guardrails as investors, but Black Swan events still abound. Expecting all investments to behave according to script can be a psychological trap. When the unexpected happens and a stock tanks, it can unleash disproportionate anger, since it violates the core tenets of their psyche. Knee jerk reactions - like selling in frustrations - may happen. In this light, Type One investors should be more wary of potential deviations when investing in individual stocks, no matter how much safety checks have been performed. A higher allocation to index funds and fixed income could also help to mitigate portfolio gyrations that may lead to emotional selling at the worst times.

Why Learning about Our Motivations for Stock Picking Matters

Our best traits and core motivations are often accompanied by closely related blind spots and unhealthy biases. It is therefore important to clarify our primary motivations for investing in singular names, because they can reveal the specific personality pitfalls we face as investors.

To find out more about your typology, try the free test on my website.

I shall be writing more about Enneagram types and personal investing in the weeks to come. Stay tuned and subscribe. Meantime, visit my website “Enneagram Investing”

Follow me on Twitter @ConsumeOwnTech and Commonstock @ConsumeOwnTech

Represented by Savvy Literary

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

Latest Top 10 positions in my high conviction portfolio that combines value with growth stocks

Book recommendations on investing, consumer and technology sectors

One article delivered into your inbox every Tuesday

Preview of upcoming articles

Follow me on Twitter @ConsumeOwnTech and Commonstock @ConsumeOwnTech

I saw your Upwork post and I struggle with the same issue BUT my Substack is more focused and its still a long slog to gain subscribers... If you get some good ideas for though, let me know or contact me (I mostly live in Malaysia)...