Enneagram x Stock Picking (Part V): Type Five Investors inside their Heads

Though intellect is important on the investing journey, it can also backfire. By Benjamin Tan

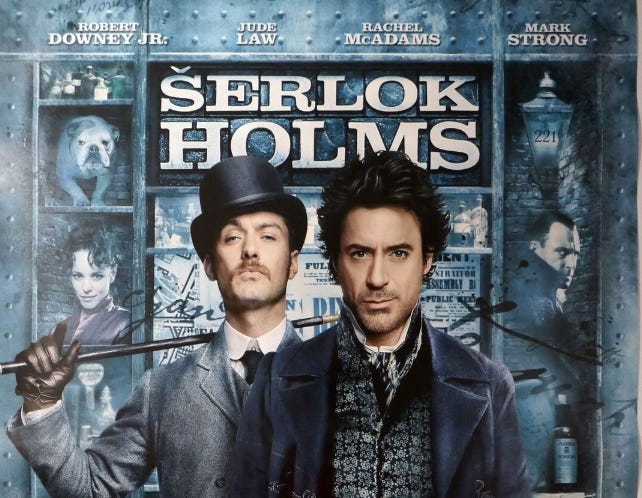

Ever watched the 2009 film Sherlock Holmes directed by Guy Ritchie? The movie stars Robert Downey Jr., who plays the titular character with an enthralling mix of eccentricities and intelligence. He does a brilliant job portraying the protagonist, who is a quintessential Enneagram Type Five

In the film, Holmes is often depicted to be deep in his thoughts. He conducts unusual and indulgent home experiments on animals – including houseflies – as he secludes himself in his flat for weeks at a time. “There's nothing of interest for me out there on Earth” declares Sherlock Holmes to his only friend Dr. John Watson.

This is classic Type Five behavior. Intellectually, Holmes is almost unequalled in his ability to solve cases. At his best, he is resourceful, perceptive, and in command of himself even in the face of danger. He connects dots that few can even discern and makes inferences like a computer to get from one clue to the next. Those around him can barely keep up.

Type Fives: Investigators

If you respond “Yes” to most of the statements below, you may be a Type Five:

You tend to be stingy on yourself, believing that you do not need the experiences or possessions that many of your peers seem to enjoy

Often, you choose to spend time away from friends and family so that you can preserve your capacity to engage in your own project

Rather than a “Just Do It” approach, which you may find reckless, you take your time to observe first and undertake intentional studies before participating in anything new

You are less willing to try out new activities, preferring your usual routine

Growing up, you identified as more separate from (than connected to) your parents or caregivers, and historically did not have much emotional reliance on them

Social interactions can feel intrusive and draining

Type Five Investors: Investigative and Curious

It is no coincidence that Type Fives are commonly known as the Investigators. They love digging deep into anything that captures their imagination. As investors, Type Fives are suited to doing due diligence to size up opportunities. Knowledge is power to Type Five investors and there is no end to their learning journeys. They are reliably thorough in their investment research processes, leaving no stones unturned.

Type Fives represent the cerebral triad (alongside Types Sixes and Sevens) of the Enneagram more than the others. Unlike Type Sixes that shuffle between internal thoughts and external opinions, or Type Sevens seeking mental stimulations from outside experiences, Type Fives are rooted in their own minds.

Having a mind of one’s own may be an investor’s best defense against information overload. Media channels are getting better at turning the mundane into headlines. We could be in hyper-inflation, deflation, economic recession, or uninterrupted economic expansion, all at the same time, depending on which topics are trending. Clickbaits are valuable, since the more impressions media companies generate on their websites, the more advertising dollars are earned. The ability to tune out noises can buy Type Five investors a sense of security in this environment and minimize knee-jerk reactions.

Potential Pitfall: Insular Thinking

The same detachment can lead to closed mental loops that are divorced from changing realities. Sticking one’s head in the sand is a common investing phenomenon among Type Five investors, and it can be costly.

As detailed in an earlier post, my former investment in Peloton (PTON 0.00%↑) is an example of insular thinking. I ignored the major red flags for too long over the course of 2021. Their escalating costs, multiple debacles with Tread, and capital raise in late 2021 were canaries in a coal mine. Conor MacNeil of Investment Talk recounts all the major missteps in his excellent coverage here and got out of the stock sooner than I did. My saving grace was a strict limit on single stock exposure and sheer portfolio diversification.

Why Learning about Our Motivations for Stock Picking Matters

This is Part Five of a series of post that I will be writing on Enneagram x Stock Picking. Below are the links to Part One (Type One Perfectionist), Part Two (Type Two Giver), Part Three (Type Three Achiever), and Part Four (Type Four Individualist)

Enneagram x Stock Picking (Part I): Type One Perfectionists

Enneagram x Stock Picking (Part II): Type Twos Investing in AMC to Save Movie Theaters?

Enneagram x Stock Picking (Part III): Type Three Investors, Successes, and Delaying Gratification

Enneagram x Stock Picking (Part IV): Type Four Investors and their Emotions

Our best traits and core motivations are often accompanied by closely related blind spots and unhealthy biases. It is therefore important to clarify our primary underpinnings for investing in singular names, because they can reveal the specific personality pitfalls we face as investors.

To find out more about your typology, try the free test on my website.

I shall be writing more about Enneagram types and personal investing in the weeks to come. Stay tuned and subscribe. Meantime, visit my website “Enneagram Investing”

Follow me on Twitter @ConsumeOwnTech and Commonstock @ConsumeOwnTech

Represented by Savvy Literary

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

Latest Top 10 positions in my high conviction portfolio that combines value with growth stocks

Book recommendations on investing, consumer and technology sectors

One article delivered into your inbox every Tuesday

Preview of upcoming articles